Crypto loans

Read More

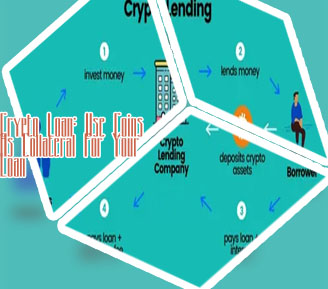

Just as customers at traditional banks earn interest on their savings in dollars or pounds, crypto users that deposit their bitcoin or ether at crypto lenders also earn money, usually in cryptocurrency. Borrow crypto Crypto loans also accentuate the value of borrowers’ crypto assets while holding them without any plans to sell them further. The crypto assets offered as collateral are not available for trading during the stipulated loan tenure. The exchange process of the crypto loans occurs between the lender and the borrower at a specific interest rate on the loan. Like traditional loans, the crypto loan amount is given to the borrower in his account, and the borrower is supposed to pay the EMIs to the person who is lending the crypto loan. Once the borrower is completely done with paying the amount, the lender then releases the borrower’s crypto assets, collateralized as loan security.

Loans on crypto

Nebeus is an all-in-one crypto staking platform that allows you to rent your crypto, the site’s name for crypto lending. It’s one of the best crypto lending platforms precisely for the all-in-one service it offers — storing, exchanging, insuring, lending, staking, and borrowing. Maintaining the status quo: FFSP transitional relief to continue into March 2025 Waiting time for approval can also be slow with traditional loans, which often take days, if not weeks, to be approved. However, crypto loans can be approved in just 24 hours and don’t require the same amount of paperwork as a traditional loan. Platforms that use a peer-to-peer (P2P) network tend to take a bit longer, however, as cooperation between lender and borrower is required.

What Can You Use Crypto Loans For?

To invest in crypto loans, you need first to open a crypto wallet. With the wallet, you’ll be able access and participate in Defi protocols, trade major currencies like Bitcoin and Ethereum, and use decentralized or centralized financial applications. Note that, at present, most DeFi systems are built on Ethereum. Then choose which of the DeFi lending platforms you’d like to invest in and connect your wallet. Start your DeFi investment portfolio through crypto loans and have fun monitoring your assets! Where can you take out a crypto loan? Before borrowing a crypto loan from Binance, you should be aware that the exchange requires collateral, and there is a minimum amount you can borrow, depending on the asset you need to process your loan. Here's how you can borrow a crypto loan on Binance:

Borrow cryptocurrency

Once you're approved for a crypto loan, you should receive funds in a short amount of time, usually a few hours. This is one of the major reasons many believe crypto loans to be more efficient than traditional bank loans. Borrow Like A Pro You won't have to undergo a credit check to qualify for a crypto-backed loan, which may make it a great option for borrowers who don't have the best credit histories. You can often qualify for a lower rate with a crypto-backed loan than with an online personal loan.