Btc stock to flow

Recent Research Reports

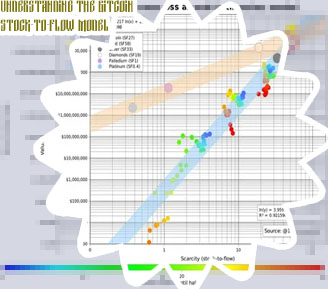

The S2FX model solidifies the facts presented by the original stock-to-flow model and offers a new way of transitioning into the next phase of BTC. According to the S2FX model, the market capitalization of Bitcoin is expected to grow to $5.5 trillion in its next bull phase. This translates to an estimated BTC price of $288K. As more assets are added to the S2FX equation, validating the accuracy of the data used, the stock-to-flow ratio is likely to become a valuable, robust model for more accurate predictions in the future. Btc stock to flow chart In the model, the stock is the size of the existing stockpiles or reserves of an asset while the flow is the annual production. Looking at Bitcoin, the stock is the number of circulating coins–currently close to 18.3 million–while the flow is the number of new bitcoins produced each year.

Stock to flow chart bitcoin

The price of Bitcoin is notoriously driven by sentiment. When the market shifts to its “greed” phase, Bitcoin soars amid the utopian promises and speculators dismiss the risks of an asset that generates no cash flow. In the “fear” phase, Bitcoin’s price seems to find no traction, as sellers push its price lower amid bad news or general market malaise. Fintech and New Technologies These three examples of phase transitions in water, US Dollar and BTC offer a new perspective on BTC and S2F. It is important to not only think in term of continuous time series but also in phases with abrupt transitions. In developing S2FX model, I see BTC in each phase as a new asset, with totally different properties. A logical next step is identifying and quantifying BTC phase transitions.

Latest On Bitcoin/USD Coin Metrics

Considering this rebound and the volatility of the cryptocurrency markets in general, it is not entirely possible to rule out any price prediction and conclusively evaluate the accuracy of PlanB’s S2F model. It is also noteworthy that even though ever since the model entered the public consciousness in March 2019 it has been fairly accurate in predicting BTC’s price, in the bull run starting late in Q4 2019, the market price of the token exceeded the forecasted price till May this year. This could also be considered as an aberration as the correlated stock to flow deflection value would indicate that the token is overvalued. What Is Stock To Flow (S2F)? If desired rename s2f.py to s2f. Just type s2f.py into your terminal. Try s2f.py --help to get help.

Stock flow model bitcoin

6mWhat is the Stock to Flow model?In simple terms, the Stock to Flow (SF or S2F) model is a way to measure the abundance of a particular resource. The Stock to Flow ratio is the amount of a resource held in reserves divided by the amount it is produced annually. How Has the Stock-to-Flow Model Performed? The stock-to-flow model has been a prominent topic of discussion in the cryptocurrency community over the past several years. Many Bitcoin enthusiasts have supported the model due to its optimistic price predictions, while others have criticized it for its inaccuracies.